The reward for today's investor?

Many stock market indicators are about as useful as cracked crystal

balls. But Robert Shiller, a professor of economics at Yale

University, advocates one forecasting tool that has demonstrated a

modicum of predictive power over the long term.

At first glance his favoured indicator looks a lot like the familiar

price-to-earnings ratio. But while the standard P/E formula divides a

stock's price by its earnings per share over the last year,

Prof. Shiller's method divides the stock's price by its average

inflation-adjusted annual earnings over the last 10 years. He calls

the result a cyclically adjusted P/E ratio, or CAPE.

In contrast to a standard P/E ratio, CAPE gives you a much better

picture of how prices stack up against a stock's typical earnings

power. It smooths out temporary gains or losses. This can be vital in

cases where profits jump around a lot from year to year.

Take U.S. banks as an example. They were gushing profits during the

real estate boom of the mid-2000s but then lost vast sums of money in

the crash of 2008. It would have been wrong to extrapolate either the

boom-time profits or the recessionary red ink.

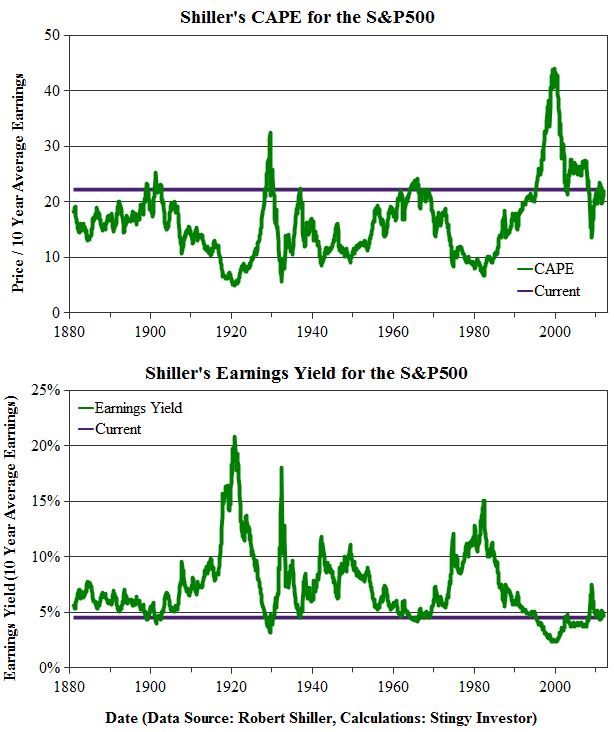

CAPE is particularly interesting when you apply it to the entire

market. Prof. Shiller's CAPE for the S&P 500 is shown in the

accompanying graph. The horizontal line on the graph highlights the

market's current CAPE of 22.1. As you can see, that's quite high

compared to the median level of 15.8 and suggests the market is

overvalued.

[larger version]

You can view the same data another way. The market's earnings yield is

its earnings expressed as a percentage of its price. It's the number

of pennies of profit for every dollar you invest. You can think of the

earnings yield as the mirror image of the standard P/E ratio, but

earnings yields tend to be more intuitive because they are quoted in

percentages just like interest rates or dividend yields.

The second graph displays Prof. Shiller's earnings yield (again using

10-year average earnings) for the S&P 500. It shows the current

earnings yield of 4.5 per cent is far below the historical median of

6.3 per cent.

Both graphs buttress the notion that the S&P 500 is expensive

today. That's good news for investors looking to sell but not so happy

news for buyers. If Prof. Shiller's earnings yield suddenly moved back

to its long-term median level then the market would drop by almost 30

per cent.

History suggests that long-term returns are likely to be meagre for

those buying in at today's prices. Previous periods when earnings

yields were between 4 per cent and 5 per cent produced average annual

returns (adjusted for inflation and including reinvested dividends) of

a mere 2.6 per cent over the subsequent 10 years.

If history repeats itself, today's investors have little margin of

safety. In a market like this, it's important for investors to keep

management fees and taxes to a minimum because reducing such levies

are likely to mean the difference between long-term gains and losses.

First published in the Globe and Mail, April 7 2012.

|

|